The endless flood of both central bank and fiscal stimulus means that hundreds of billions of liquidity – to the tune of approximately 0.7% of global GDP every single month…

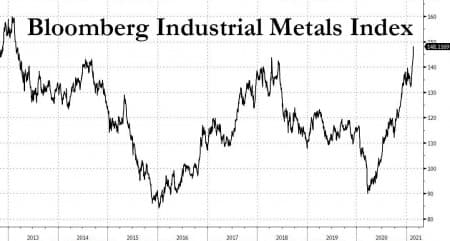

The endless flood of both central bank and fiscal stimulus means that hundreds of billions of liquidity – to the tune of approximately 0.7% of global GDP every single month are entering the market every month, and the result is not only the continued push higher in risk assets but soaring commodity prices, with industrial metal prices powering to the highest in years on bets an economic recovery and worldwide push for cleaner, greener energy will unleash vast, pent-up demand.

As the chart above shows, nowhere has the recent surge been more evident than in the dramatic gains across the base metals complex, with nickel at its highest since 2014 and copper eyeing a record stretch of monthly advances as it creeps closer to $10,000 a ton.

And looking at copper, which is already where it traded just before the global financial crisis it is only a matter of time before we see a new all time high. Indeed, overnight copper extended its surge to a nine-year high as Goldman Sachs warned of a historic shortage with “the market now on the cusp of the tightest phase in what we expect to be the largest deficit in a decade” as Chinese buying “triggers the next leg higher” adding to expectations that prices will near a record sooner rather than later. Here are some highlights from a note published overnight by Goldman analyst Nicholas Snowdon:

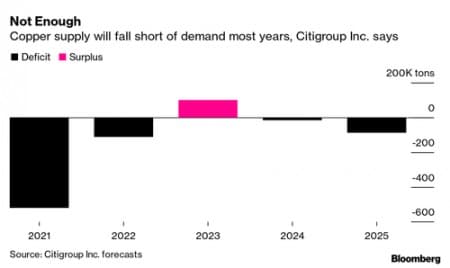

China’s return from the LNY holiday has heralded a burst of onshore investor copper buying after the holiday season with limited inventory builds evident so far. This latter trend during a period of what should be peak surplus generation onshore, has particularly bullish implications given that the market is now on the cusp of the tightest phase in what we expect to be the largest deficit in a decade. The very low starting point for inventories at the beginning of this year has been further exacerbated by a counter seasonal stock draw so far in Q1 on a scale only seen once before in recent history (in 2004). These trends point towards a high risk of scarcity conditions over the coming months. In this context, the fundamental outlook for copper remains extremely bullish with no evidence that current price levels are yet stimulating softening effects to reverse both spot and forward fundamental tightening trends. We continue to forecast the largest deficit in 10 years in 2021 (327kt), followed by an open-ended phase of deficits as peak copper supply (2023/24) and a record 10-year supply gap on the horizon. To reflect the rising probability of scarcity pricing our new 3/6/12M copper targets increase to $9,200/$9,800/$10,500/t (from $8,500/9,000/10,000/t previously). We consider below the key bullish increments for copper supporting the revision higher in price targets.

This means that Goldman now expects copper to be trading at record highs in 1 year. Anyway, back to the note:

Chinese investors have refocused on copper. The absence of Chinese investor copper buying for the year-to-LNY period was a clear restraint on copper price action. Chinese buying had been the key buying channel from early November which took copper from $6,600/t to $8,000/t in just six weeks but then dissipated from year-end. However, today on the open after a week holiday we saw SHFE copper interest increase by 22k lots (+8%) set against a strong rise in price (Exhibit 3). This points clearly to the return of very strong onshore investor buying. The absence of this investor flow pre-LNY was in our view predominantly related to typical position squaring into the holiday period rather than reflecting a substantially different view on copper. With that calendar restraint now passing, we expect a sustained wave of Chinese buying. We would note that total SHFE copper open interest (324k lots) is still 16% below late November recent peak (377k lots) as well as 40% below record highs. Therefore we believe there is ample capacity for further onshore positioning extension in copper. We would also note that positioning on Western exchanges (LME, COMEX) has remained relatively stable at significant net long levels, but still substantially below record net length (COMEX money manager net long still 30% below September 2017 record net long). In our view the market remain some distance from approaching peak spec long capacity.

Citi agreed with Goldman, expecting a substantial supply deficit until at least 2023.

It wasn’t just copper: other commodities have also soared with lithium, key to powering electric cars and backing up renewable energy, rebounding. And while tin headed for an unprecedented 16th straight weekly gain amid a supply squeeze, Platinum has been this year’s top-performing major precious metal, thanks to its use in catalytic converters.

Source : oilprice.com

I want looking through and I conceive this website got some truly useful stuff on it! .