Mining and commodities trader Glencore (LON: GLEN) said on Friday that Gary Nagle, the head of its coal division, would replace Ivan Glasenberg as the company’s top boss early next year.

Glasenberg, who has led Glencore since 2002, said in 2018 that he would step down in three to five years. At the time, he added the firm had already begun training a small group of front runners to take over the post.

“It’s time to hand over to a new generation and a new leader,” Glasenberg said on an investor call. “We’ve decided that over the next six months I will be working closely with Gary Nagle, who will be taking over from me.”

Nagle, like Glasenberg, is South African and holds degrees in commerce and accounting from the University of Witwatersrand.

Just as the departing CEO, Nagle built his career by rising through the ranks of Glencore’s coal department, where he has worked for the past 20 years.

Zero emissions by 2050

The announcement came as the Swiss firm revealed an ambitious plan to reach net-zero emissions by 2050 through reducing its direct and indirect carbon footprint by 40% by 2035, compared to 2019 levels.

Glencore, one of the world’s largest coal producers, also said it would focus on investing in metals considered “vital” for the transition to a lower carbon world.

While the company noted that thermal coal’s weight on the group’s earnings has dropped between 10 and 15%, from 25-40%, it said it did not believe that selling its coal mines would help reduce associated emissions.

The company has already made some concessions. It promised in February last year to cap coal production, not to make any further coal acquisitions that would add to overall output, and to align its business strategy with Paris climate targets.

“Our ambition to be a net zero total emissions company by 2050 reflects our commitment to contribute to the global effort to achieve the goals of the Paris Agreement,” Glasenberg said in an update to investors.

Glencore, also a major cobalt and copper miner, highlighted the company’s current exposure to those two metals, which are essential in the production of electric vehicles batteries and renewables.

Growing trend

The mining and metals sector is facing greater scrutiny from communities at host countries, end consumers and society at large, demanding a lower carbon footprint as well as transparent, ethical supply chains.

Most top miners are well aware of the need for change, and have already kicked off company-wide initiatives.

BHP (ASX, LON, NYSE: BHP), the world’s no. 1 miner, has committed $400 million over five years to reduce greenhouse gas emissions from its operations and mined commodities.

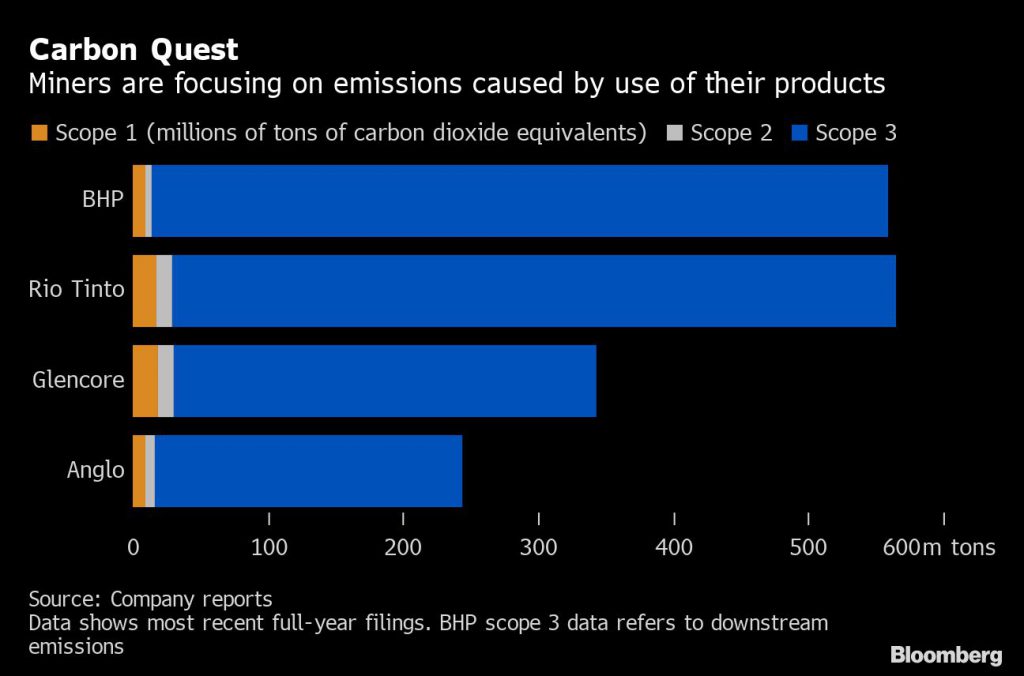

It has also vowed to reduce its Scope 3 emissions — those generated when customers burn or process the raw materials it mines — which are 40 times greater than those generated by its mines and oilfields.

Rio Tinto (ASX, LON, NYSE: RIO), the world’s second-largest mining company, has vowed to spend $1 billion over the next five years to reduce its carbon footprint and have “net zero” emissions by 2050. The company, however, has yet to commit to tackle its Scope 3 emissions.

Fortescue Metals Group (ASX: FMG), the world’s fourth-largest iron ore producer, brought forward in June a self-imposed deadline to be carbon-neutral. It now expects to reach such goal by 2040, 10 years earlier than its closest rivals BHP, Rio Tinto and Vale.

Anglo American (LON: AAL) has also set 2040 as deadline to become carbon-neutral mining. It has spent this year taking actions towards achieving that goal, including installing floating solar panels on a copper mine’s waste pond.

Both the management transition and the “greener” objectives announced by Glencore today come as the company faces pressure on multiple fronts, including corruption probes, pollution accusations and a share price that has lost half its value during the past decade.

Source : mining.com/ Image : Gary Nagle. (Image courtesy of Glencore | Twitter.)

Great post. I used to be checking constantly this weblog and I’m inspired!

Extremely useful info particularly the closing phase

🙂 I take care of such information much.

I was looking for this certain info for a very long time.

Thank you and best of luck.

Simply wish to say your article is as surprising.

The clarity in your put up is just excellent and i

can assume you’re knowledgeable on this subject. Well with your

permission let me to take hold of your RSS feed to stay updated with impending post.

Thanks a million and please keep up the enjoyable work.