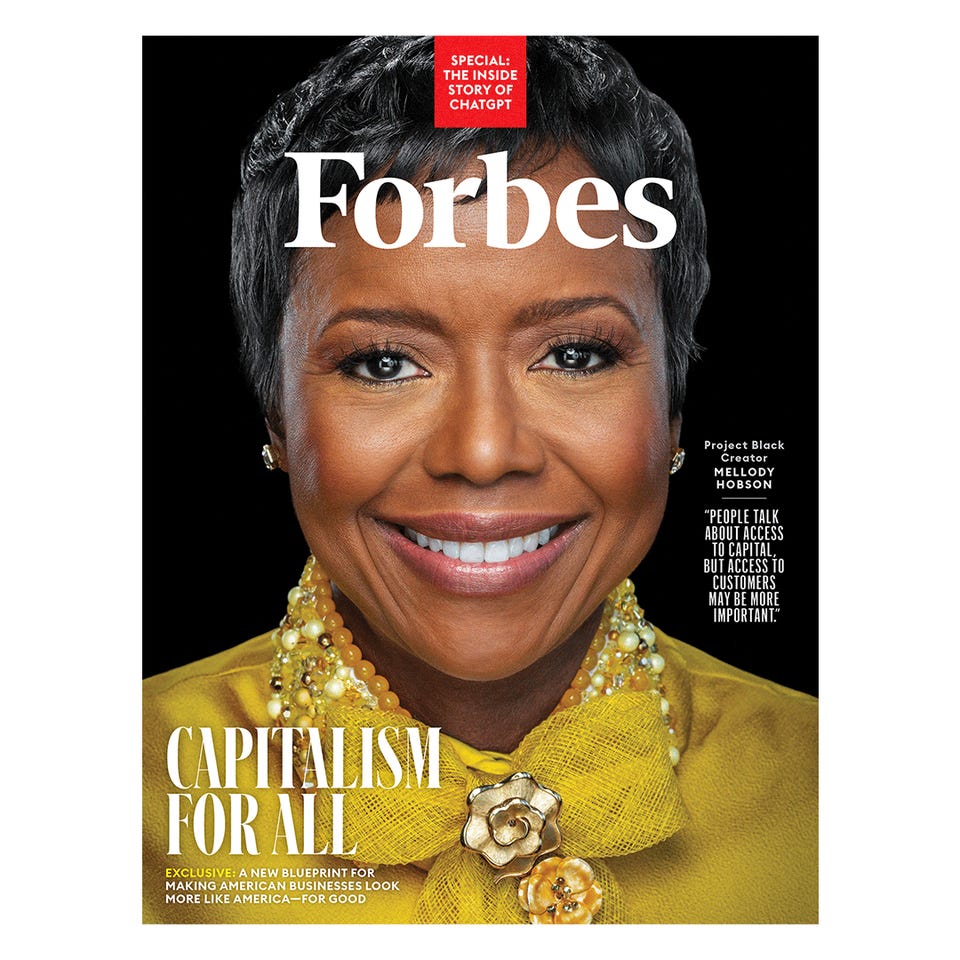

Mellody Hobson, Co-CEO & President at Ariel Investments JAMEL TOPPIN FOR FORBES

To boost more talented minority executives into the corporate stratosphere, Ariel Investments’ Mellody Hobson wants to install them at the top of existing businesses—and connect them with the customers and capital to succeed.

Asa sixth grader in Chicago public schools in 1980, Mellody Hobson was mortified by the snaggletooth that protruded when she smiled. It simply didn’t fit the future she envisioned for herself.

She asked her friends who wore braces for the name of their orthodontist, and without her mother knowing, made an appointment, walking from school to his office. He said she’d have to wear braces for years and that it would cost $2,500—a monumental sum for Hobson’s struggling single mother, who was raising her and her five siblings in a home where money was so tight the electricity was periodically shut off because of unpaid bills. No matter. That tooth was going to be fixed: Hobson and the orthodontist agreed to a payment plan of about $50 per month.

In eighth grade, determined to go to one of Chicago’s best private high schools, she asked friends where they were applying, called the schools and arranged to tour them with her mother in tow. She wound up at St. Ignatius College Prep on a scholarship.

Photo by Jamel Toppin for Forbes

In 2020, in the wake of the nationwide George Floyd protests, JPMorgan Chase CEO Jamie Dimon wanted to aid Black businesses. He called Hobson, by then a JPMorgan board member, hoping to tap into that same sheer force of will. “I said, ‘We really need a sustainable investment effort—totally for-profit—to invest in minority companies,’ ” Dimon recalls. He told her he wanted Ariel Investments, where Hobson is co-CEO and president, involved, then rattled off other minority-owned businesses as potential partners.

Hobson was characteristically blunt but upbeat. “I said to him, ‘Jamie, [some of] these companies are gone,’ which he did not know. ‘But I think I have an idea.’ ” She drafted a four-page memo outlining “Project Black” and emailed it to Dimon on September 8, a week after his initial call.

The idea: Ariel would form a private equity fund to invest in middle-market companies and provide them the capital—and, more crucially, the contacts—needed to sell to large corporations eager to diversify their supply chains. Dimon was sold instantly. “When people talk about Black businesses, they talk about access to capital, access to capital, access to capital,” Hobson says. “Access to customers may be more important.” Currently, a meager 2% of corporate spending goes to minority-owned suppliers.

There’s another conventional wisdom-busting aspect of this strategy. Black entrepreneurs start lots of businesses, but very few grow large enough to become suppliers to the Walmarts of the world; of the 500 or so private companies in the U.S. with more than $1 billion a year in sales, just five are Black-owned.

Project Black aims to leapfrog the size barrier by acquiring companies with $100 million to $1 billion in sales and, if they’re not already minority-run, installing Black and Latino executives to manage them—“minoritizing” the companies, as Hobson puts it. These firms should then be well positioned to acquire smaller enterprises owned by underrepresented minorities and to grow into competitive top-tier suppliers—satisfying big companies’ supply chain needs and diversity goals at the same time.

Hobson “is as comfortable with a part-time barista as she is with any high-profile person,” says Starbucks’ Howard Schultz.

On February 1, Ariel closed its first Project Black fund with $1.45 billion in commitments from AmerisourceBergen, Amgen, Lowe’s, Merck, NextEra, Nuveen, Salesforce, Synchrony, Truist, Walmart, the Qatar Investment Authority, Hobson’s family foundation and former Microsoft CEO Steve Ballmer, who put $200 million in. That’s all on top of an up to$200 million pledge that JPMorgan made in 2021 to get the ball rolling.

That $1.45 billion is more than five times the size of the average first-time private equity fund and brings assets under management at Ariel, including its mutual funds and separately managed accounts, above $16 billion. Forbes figures Hobson’s nearly 40% stake in what is the nation’s oldest (founded 1983)Black-owned investment shop is worth $100 million. (John W. Rogers Jr., the founder, chairman and co-CEO, owns 34%.)

Like so much else the 53-year-old Hobson has done during her one-of-a-kind career, the Project Black memo was neither off-the-cuff nor a solo production. Instead, it was built on years of relentless hard work, analysis and networking. After the May 2020 murder of Floyd by a Minneapolis policeman, Hobson organized Sunday Zoom calls with a cadre of top Black business executives to brainstorm ways that capitalists could narrow the racial wealth gap—and make a profit. “I said, ‘This hasn’t been done before.’ ”

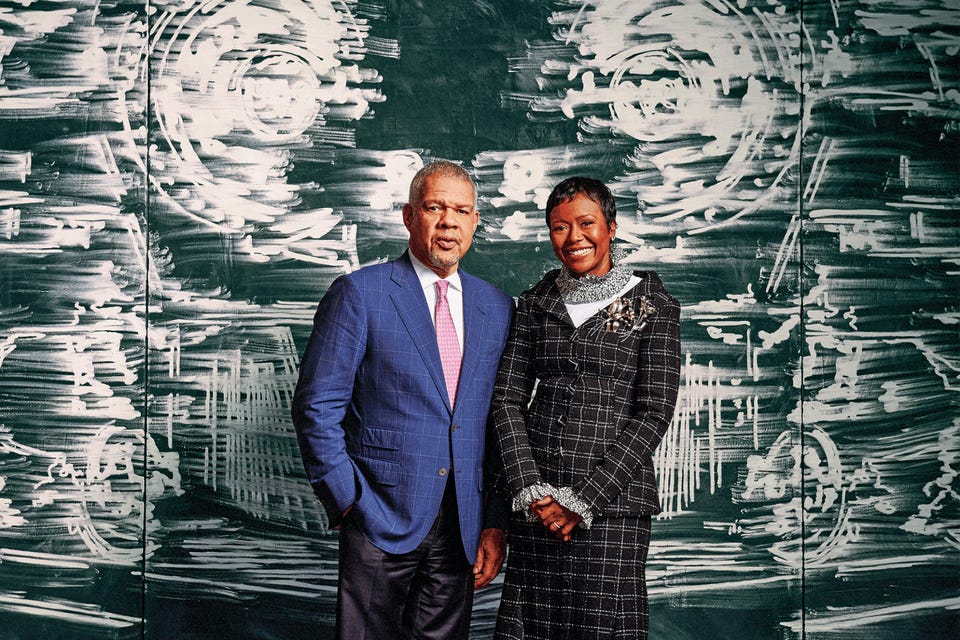

One Zoom regular was Leslie A. Brun, the 70-year-old Haiti-born founder and former head of Hamilton Lane, which now oversees $824 billion in alternative investments. He’s CEO (and, with Hobson, cofounder) of Ariel Alternatives, which is running Project Black. “We could change the paradigm and the conversation about what it means to be a minority-owned business,” he says, “because if you look at the federal definition, it’s small and disadvantaged. We want to be large and advantaged.”

Among value investing firms, Ariel Investments is known for a patient, contrarian buy-and-hold approach. Turtles and tortoises—metal figurines, wooden replicas, stone sculptures and tortoiseshell imprints—decorate nearly every office and conference room in both its Chicago headquarters and Hobson’s main office in San Francisco’s Presidio.

Yet Hobson’s rise at Ariel was anything but slow. Founder Rogers hired her right out of Princeton and let her know, when she was just 25, that he planned to make her its president by the time she was 30. “Whenever you have a star, you want them to see a career path—that’s basic business 101,” says Rogers, who first spotted Hobson’s promise when she was a high school senior and he was recruiting Chicago students for Princeton.

Back in the Game: Leslie A. Brun (left) was happily managing his family investments and serving on boards (including Ariel Investments’) when Hobson asked him to become CEO of Ariel Alternatives and run Project Black. “It was a no-brainer to say yes,” he declares. JAMEL TOPPIN FOR FORBES

Even in grade school, Hobson fixated on education as her ticket to a secure future. She was by far the youngest of Dorothy Ashley’s six children—her oldest sibling is more than two decades her senior. Hobson describes her mother as loving, optimistic (sometimes unrealistically so) and hardworking. Ashley tried to make a living renovating condos, but between discrimination and spotty money management skills, she couldn’t always pay the bills. Hobson’s childhood was peppered with multiple evictions and utility shut-offs.

“It felt extremely insecure,” says Hobson, who has become a powerful advocate for financial literacy. “I ended up knowing way more about our life than any child should know. I knew what our rent was. I knew when our phone bill was late.”

Hobson had been accepted to both Harvard and Princeton and was set on Harvard until she attended a Princeton recruitment dinner, organized by Rogers, at the Chicago Yacht Club. Venture capitalist Richard Missner sat down beside her and declared that he intended to change both her choice of college and her life. He began calling her every day, eventually inviting her to a breakfast for one of his Princeton classmates—then-U.S. Senator and former New York Knicks star Bill Bradley—seating her next to the guest of honor.

“Mellody made a very deep impression on me,” Bradley says. “She is where she is today because of the values she held as a high school senior, her incredible discipline and a positive energy level that made people want to be around her.” Hobson chose Princeton, and a lasting friendship was born.

When Bradley ran for the Democratic presidential nomination in 2000, Hobson was a tireless fundraiser, impressing another Bradley backer: Starbucks billionaire Howard Schultz. Hobson joined Starbucks’ board in 2005 and became nonexecutive chair in 2021, making her the only Black woman currently heading an S&P 500 board.

“The currency of the way she carries herself is steeped in emotional intelligence,” Schultz says. “Mellody is always present. She puts on no airs. She’s as comfortable with a part-time barista as she is with any high-profile person you can mention.”

Schultz introduced Hobson to DreamWorks Animation CEO Jeffrey Katzenberg, who in turn recruited her for his board. Hobson became chair of DreamWorks in 2012 and in 2016 negotiated its sale for $3.8 billion (a 50% premium to its stock price before talks became public) across from Comcast CEO Brian Roberts, a famously tough bargainer. “She had never bought or sold a company before, but you would have thought she had been doing this her whole life,” Katzenberg marvels.

The movie connection presumably gave Hobson something to talk about when she met Star Wars creator George Lucas at an Aspen, Colorado, business conference in 2006. On their first dinner date they talked about their shared commitment to promoting educational access. When she married the billionaire in 2013 at his Skywalker Ranch in California, Bradley walked her down the aisle. (Lucas, Hobson and their 9-year-old daughter have their primary homes in California, as well as a penthouse in Chicago.)

It’s a lifelong pattern: One A-list friend or business associate is wowed and introduces Hobson to another, who repeats the process. She met Formula 1 champion Sir Lewis Hamilton in 2007 through Lucas, a racing enthusiast; she now calls the British driver her “little brother” and included him in the new Denver Broncos ownership group (Hobson owns 5.5%) headed by billionaire Walmart heir Rob Walton.

Former Meta COO Sheryl Sandberg and Hobson bonded when both served on Starbucks’ board. Hobson was there for her, Sandberg says, when her husband died suddenly from a heart condition in 2015. Tennis great Serena Williams met Hobson through a mutual friend, Grammy-winning singer Alicia Keys. “We totally hit it off. I admired what she was talking about,” Williams says. “Now, it’s so funny. I don’t remember anything she said—I just remember being totally enamored by how authoritative she was. For me, it’s always so exciting to see someone like her, in that position, to be so confident to have that aplomb when she walks into a room.”

No relationship has been more important to Hobson than her apprenticeship-turned-partnership with Ariel founder John W. Rogers Jr. The 64-year-old Rogers grew up in a different world: His father was a Tuskegee Airman and a judge. His mother was the first Black woman to graduate from the University of Chicago Law School and the granddaughter of one of the architects of Greenwood, the prosperous Black community in Tulsa destroyed by a white riot in 1921. Rogers captained the Princeton basketball team when Craig Robinson, Michelle Obama’s brother, was a freshman on it. He later became close to the Obamas, chairing the president-elect’s first inauguration committee and giving him Ariel’s offices to work from after his victory.

When Hobson came home from Princeton for Christmas break her sophomore year, Rogers invited her to meet his mother, Jewel Lafontant, at her Water Tower Place apartment. “I was in this beautiful apartment, and it just seemed so normal to them, and they were Black, which I had not ever seen before,” Hobson says. “The bar got reset in that moment.”

While interning at Ariel the following summer, Hobson didn’t hide her ambition. On Saturday mornings, Rogers would go to a McDonald’s downtown—on Wabash Avenue under the train tracks, Hobson remembers—order two biscuits with butter and a large Diet Coke and sit there reading a stack of newspapers. Hobson would show up with the same stack of papers and read them in the same order—just so she’d be prepared in case he commented on what he was reading.

“She was always eager to jump in the car wherever I was going,” Rogers says. He helped her get an internship with T. Rowe Price the next summer, and she interviewed with big Wall Street firms for a job after graduating from Princeton in 1991. But she joined tiny Ariel instead. Rather than being a small cog in a huge machine, she wanted to start her career in the room where decisions were made.

Rogers manages Ariel’s stock picking and investment strategies; Hobson oversees everything else. She became co-CEO in 2019, the same year she bought 14% of Rogers’ ownership stake—making her the largest shareholder in Ariel, with 39.5%. (Read more about Rogers’ 2023 best idea stocks here.)

In its 40 years, Ariel has gone through some rough patches—the most harrowing during the 2008 global financial crisis, when the Ariel Fund, its largest, fell 48% and investors fled. The firm’s assets collapsed from $21 billion in 2004 to just $3.3 billion in March 2009, and it was forced to lay off 18 of its 100 employees. Hobson and Rogers visited their friend and mentor, billionaire investor Mario Gabelli, for advice. “Keep your seat belt fastened. Don’t sell the business,” Gabelli recalls telling them. “Don’t look for an equity partner. Keep it yourself and go full speed ahead.” They sent Gabelli a thank-you note, and after the Ariel Fund returned 63% in 2009, crushing its competition, he sent that note back to them in a frame with “I told you so” scrawled in big letters on top.

Project Black made its first investment last year, acquiring 52.5% of Utah-based Sorenson Communications from other private equity investors at an enterprise value of $1.3 billion. The two-decade-old company, with $837 million in sales in the year ended in September 2021, is the leader in services for the deaf and hard of hearing—providing everything from phone call captioning to sign-language interpreters. Sorenson’s new CEO is Jorge Rodriguez, a 53-year-old telecom veteran, who previously ran various subsidiaries for Mexican billionaire Carlos Slim’s América Móvil corporation.

In less than 12 months the company has gone from one person of color to 13 across its C-suite and boardroom. Sorenson is adding Spanish-language services and has agreed to acquire 70% of CQ Fluency, a business built by a woman who immigrated from Brazil. With annual revenue of $45 million, CQ provides translation services to health insurers including Cigna, Aetna and UnitedHealth Group.

Over the next three to five years, Project Black plans to similarly buy, minoritize and expand companies in six to 10 other areas where it sees room for growth, based on its conversations with larger firms. It’s looking at financial and professional services, health care, technology, manufacturing and logistics. “We don’t want to be the provider of janitorial services,” emphasizes Ariel Alternatives CEO Leslie Brun. “We want to be in the mainstream of the economy and providing value-added services.”

Hobson and Brun aren’t just working their own C-suite contacts. Some of those original Sunday Zoom participants are now advisors—people such as William M. Lewis, an Apollo partner who was chairman of investment banking at Lazard for 17 years ending in 2021, and James Bell, the former Boeing CFO whose board memberships include Apple. Naturally, Rogers, who sits on the boards of McDonald’s, Nike and the New York Times, is also an advisor.

Hobson, Brun and their backers throw around huge numbers about what Project Black and similar efforts can accomplish. Over the next decade, they forecast, their activities will lead S&P 500 companies to spend an additional $8 billion to $10 billion with Black and Latino suppliers, creating 100,000 jobs for underrepresented people. But that’s just the start. Some big corporations are talking about boosting purchases from minority-run suppliers from the current 2% to 10% or even 15%. That could translate to a trillion-dollar opportunity. The thesis, Steve Ballmer says, is that “there’s an untapped market” that “will not only benefit the community but will generate great returns for us as an investor.” Brun says he’ll consider Project Black a success if it spawns copycat investment funds.

Beyond the numbers, this is partly a networking play designed to match capital and people—which is, in essence, one of Hobson’s superpowers. Already, she says, “we’ve had people come to us and say ‘If you were to buy a business one day, maybe I could run it.’ ” She contrasts that with what she has long heard from big business. “So many times, especially in corporate America, they say they can’t identify the [minority] talent,” Hobson says. “We know them as friends. We know them up and down the food chain in corporate America. We know them as entrepreneurs. We know them as business leaders.”

Source : forbes.com