SOURCE: BENCHMARK LITHIUM ION BATTERY DATABASE Q2 2023

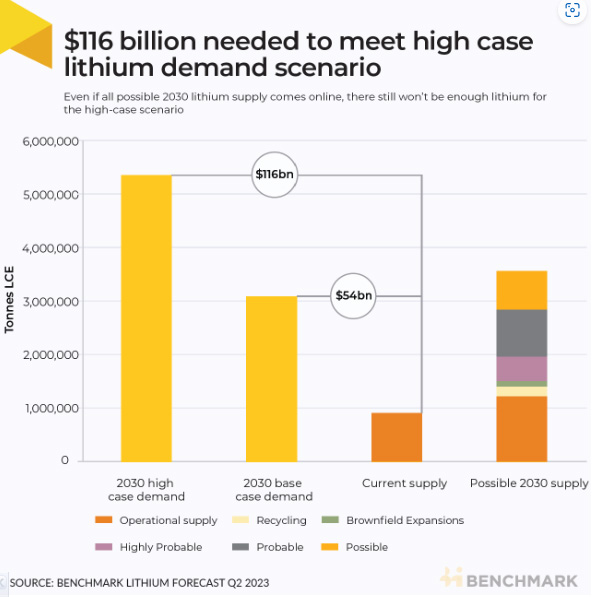

The lithium industry needs to invest $116 billion by 2030 if the world is to meet the ambitions targets set by governments and the largest automakers, according to a Benchmark analysis.

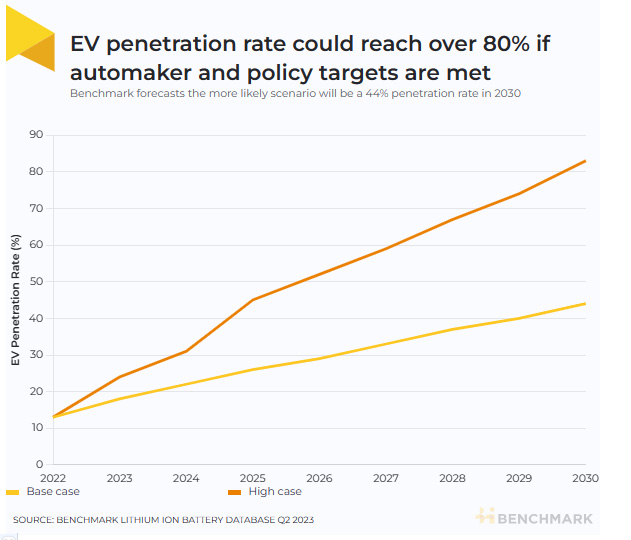

This “high case” scenario is based on automakers hitting their targets and electric vehicle penetration increasing on the back of enacted decarbonisation policies from governments around the world.

This is more than double the $54 billion investment needed to meet Benchmark’s base case lithium demand scenario. This is an updated calculation following the investment analysis Benchmark developed last quarter.

This money needs to go into building new mines and refineries, as well asexpanding existing assets. Even if every asset in the pipeline came online on time and hit their projected lithium production capacities, the world would still need 1.8 million tonnes on top of that to meet the high case demand.

The high case scenario, which encompasses data from Rho Motion on automakers’ passenger EV targets as well as data from the International Energy Agency on enacted country-level policies, would require 5.3 million tonnes of lithium carbonate equivalent (LCE). This is compared to the 915,000 tonnes LCE production in operation today.

“It’s almost impossible, and definitely a race against time,” Cameron Perks, an analyst at Benchmark, said. “The big money that needs to be spent takes time to get approval for and to deploy.”

Benchmark’s Lithium Forecast tracks around 400 projects, but Perks is concerned that those with the deepest pockets are not going to rush to invest heavily in even more projects.

“The players with skin in the game are the least likely to rush their spending,” he said. “They don’t want to flood the market with lithium too quickly. They want to release it slowly to maximise their return.”

Optimistic automakers invest upstream

A major driver behind the high case demand scenario are optimistic automaker targets.

General Motors and Mercedes-Benz, for example, aim to produce only electric vehicles by 2035 and 2030, respectively.

Stellantis aims for 100% of its Chinese vehicles to be electric by 2030. The company is also targeting 50% of all its vehicles in the US and 100% of all its passenger vehicles in Europe to be electric by 2030.

Tesla is targeting production of 20 million passenger EVs by 2030. In 2022, the company produced just over 1.3 million EVs.

Benchmark’s high case scenario forecasts that 7.0 TWh of batteries will be needed in 2030, compared to 3.9 TWh in the base case scenario.

But without large increases in the amount of lithium, these targets will be impossible to hit. With the amount of lithium production forecast by Benchmark for 2030, only 3.2 TWh of lithium ion batteries can be produced, highlighting that the mineral is a constraining factor.

“As a carmaker, consumer, or EV policy maker, should I be alarmed? Yes,” Perks said.

In order to meet these ambitious targets, automakers are increasingly cutting out the middlemen and looking to secure lithium directly.

In January this year, GM announced it would invest $650 million in Lithium Americas to help the developer progress their Thacker Pass lithium mine in Nevada.

Tesla will invest over a billion dollars to build its own lithium hydroxide refinery in Texas which began construction in May this year. Chief executive Elon Musk cites lithium chemical production as being the bottleneck for the battery industry.

Last September CATL, the world’s largest cell producer, established a joint venture with Chinese cathode producer Lopal and lithium producer Tangshan Xinfeng Lithium to build a 30,000 tonne lithium carbonate facility.

CATL also acquired Yajiang Sinuowei Mining in March this year, following its bankruptcy. The mining junior has a spodumene exploration permit.

BYD, one of the world’s largest cell and EV producers, announced in August last year that it will invest RMB 28.5 billion ($4.2 billion) to build a 30 GWh battery plant and a 100,000 tonne lithium carbonate facility that will process lepidolite.

BYD is also developing a 30,000 tonne brine project in Qinghai province as part of a joint venture with Qinghai Salt Lake.

Policy pushing up penetration rates

Another major driver for the increased demand of the high-case scenario compared to the base case is primarily driven by ambitious governmental policies that aim to reduce the carbon emissions of the transport sector.

The US is targeting a 50% penetration rate of EVs (battery, plug-in hybrid, and fuel cell) in new sales by 2030. The UK will ban the sale of new internal combustion engine vehicles in the same year, with hybrids allowed until 2035. The EU has an ICE ban from 2035.

Globally, Benchmark’s Lithium ion Battery Database forecasts that 43.7% of new vehicle sales will be electric by 2030. This drastically increases to 82.5% if OEM targets and current policy targets are met. As a result, demand for lithium ion batteries jumps in 2030 from 3.9 TWh in the base case to 6.1 TWh in the high case.

China, one of the largest EV markets, plans to phase out ICE vehicles by 2035.

A range of subsidies for EVs will also boost demand. Although the US doesn’t have a binding target for when to have out ICE vehicles by, it does have the Inflation Reduction Act which offers up to $7,500 in tax incentives to purchase EVs that meet certain criteria.

The IRA also offers generous tax incentives for the development of domestic lithium and other critical mineral resources.

The US’s Department of Energy is also contributing towards the potential $100 billion lithium bill. The department’s Loan Programs Office offered a conditional $700 million loan to Ioneer at the start of this year for its Rhyolite Ridge project which plans to produce lithium carbonate at the mine site in Nevada.

This analysis is drawn from the detail in Benchmark’s Lithium Forecast service – which provides detailed analysis and forecasts for supply, demand, prices and costs out to 2040.

Source : source.benchmarkminerals.com